If you are a Bitcoin investor with a low cost basis and liquidity needs, you might want to consider taking out a Bitcoin-backed loan. These loans use … [Read More...] about 4 Best Ways to Get a Bitcoin-Backed Loan

Intelligent Investment Research to Help You Achieve Financial Freedom

Get one of our top crypto picks by entering your info below!

Get one of our top crypto picks by entering your info below.

Proven Investment Strategies

Our wide range of investment research publications will guide you to real results.

Our Approach & Philosophy

Track cycles and identify macro trends to determine which sectors are entering bull market cycles.

Perform competitive investment research to identify companies that are undervalued relative to their competition and have the most upside potential.

Utilize technical analysis to time entry points near bottoms, pivot points or key breakout levels.

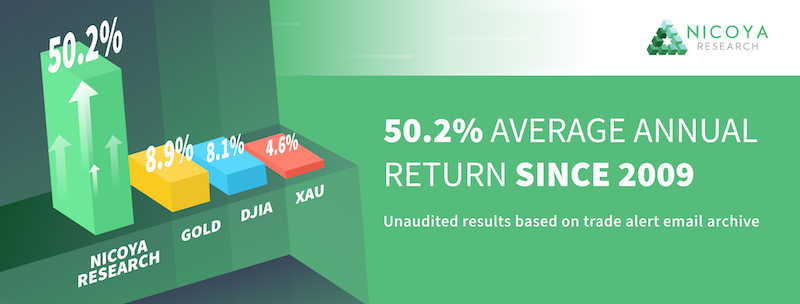

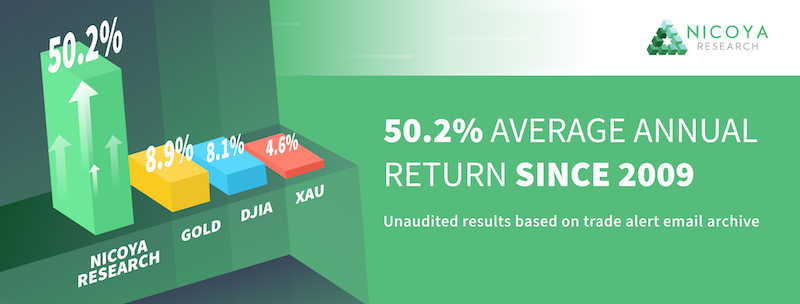

Consistent Outperformance!

Consistent Outperformance!

The Lastest News & Updates

Fetch.ai – At the Intersection of Blockchain and Artificial Intelligence

Two sectors that are vastly outperforming the markets, driving rapid growth and generating massive returns are cryptocurrency and artificial … [Read More...] about Fetch.ai – At the Intersection of Blockchain and Artificial Intelligence

3 Ways to Profit from China’s Dec 1st Graphite Export Ban

There is more graphite than lithium in electric vehicle batteries and the market for graphite used in batteries has grown by 250% since 2018. In … [Read More...] about 3 Ways to Profit from China’s Dec 1st Graphite Export Ban

Meet Jason Hamlin

Jason Hamlin is the founder of Nicoya Research and has published investment research for over a decade. He previously worked in data analytics for Nielsen, the world’s largest market research firm, where he consulted to Fortune 500 companies including Nestlé, Johnson & Johnson and Del Monte.

Jason eventually left the corporate world and leveraged his analytical skills to successfully trade stocks full-time while traveling the world. After helping his parents double their investment portfolio in under two years, Jason decided to start Nicoya Research and share his investment research and strategies to help other people find success and financial freedom. Read More...

Long time subscriber. While gold and silver haven’t done much lately, Jason’s cryptocurrency picks are up hundreds or even thousands of percent for me in 2017. Other newsletters that I follow aren’t even covering these investments. Literally DOUBLED my investment portfolio in the first half of the year!!- Antonio, stocknewsletterreviews.com